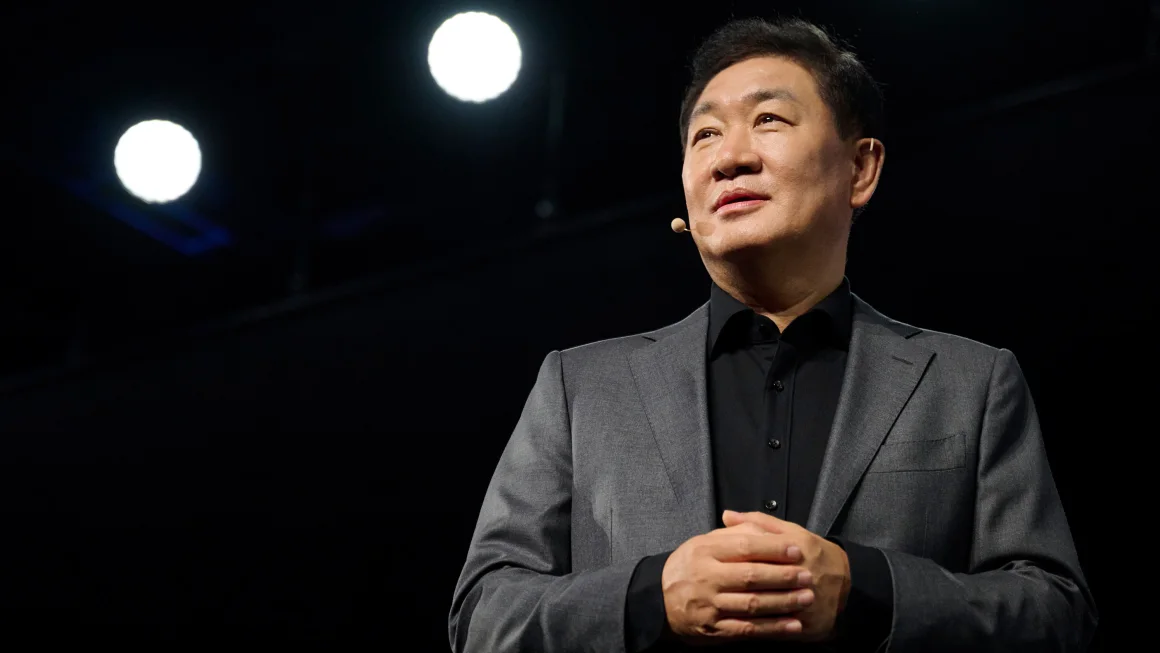

Lee Shau Kee, the influential Hong Kong property magnate and founder of Henderson Land, passed away on Monday at the age of 97, the company announced in a statement.

Known as “Uncle Four” due to his birth order among siblings, Lee was born in Guangdong, China, into a family that owned gold and silver shops. At 20, he moved to Hong Kong and later established Henderson Land in 1976. He led the company as chairman until retiring in May 2019.

At the time of his passing, Lee’s fortune was estimated at $30 billion by Forbes. His business empire, now managed by his sons Peter and Martin Lee, extends beyond real estate into sectors such as energy, retail, and transport. His success was partly attributed to strong ties with Chinese leadership, having met figures like Deng Xiaoping and Jiang Zemin.

Unlike newer generations of Hong Kong’s ultra-wealthy, Lee was vocal on various issues. He advised young people against early marriage without financial stability, citing the financial burden of raising children. Dubbed “Hong Kong’s Warren Buffett,” Lee believed that investing in real estate stocks was more profitable than the property business itself. His wealth soared before the 2008 financial crisis, during which his stock investments suffered losses.

A dedicated philanthropist, Lee donated billions to charitable causes in Hong Kong and mainland China. In 2018, he honored his pledge to contribute 1 billion Hong Kong dollars ($128.7 million) to charity when the Hang Seng Index reached 30,000 points.

Lee is survived by his two sons and three daughters.