Concerns over the economy are growing among American consumers and businesses, as inflation fears and policy changes under President Donald Trump create uncertainty. Rising anxiety has led to questions about how this shift in sentiment could impact spending, hiring, and the overall state of the world’s largest economy.

Mark Zandi, chief economist at Moody’s, noted that the economic changes under Trump’s administration are “arguably unprecedented,” leading to increased nervousness. “If confidence continues to decline for another three months and consumers actually cut back on spending, then game over,” Zandi told CNN.

Economic Uncertainty on the Rise

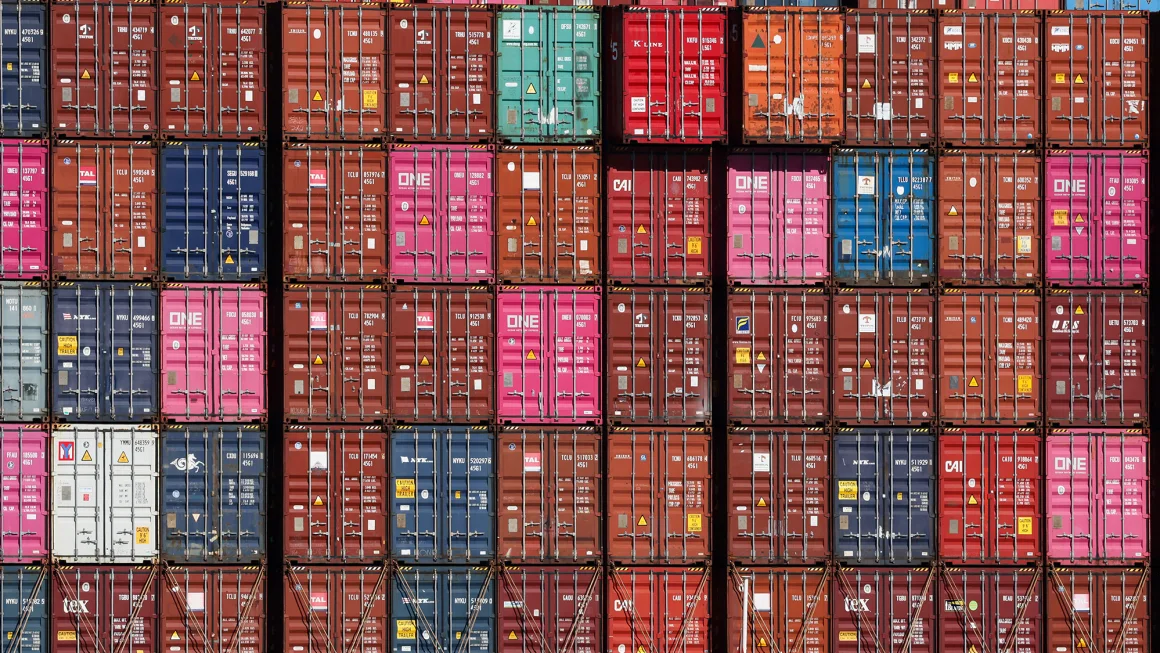

Recent surveys indicate that inflation concerns—largely driven by Trump’s tariff policies—are putting pressure on consumer confidence. In February, consumer sentiment took its steepest monthly drop since August 2021, according to The Conference Board. Additionally, the National Federation of Independent Business reported its third-highest reading ever on its Uncertainty Index for January.

Wall Street is also showing signs of worry. CNN’s Fear & Greed Index recently shifted into “extreme fear” territory, a level last seen in December.

Despite this growing pessimism, past economic data suggests that declining sentiment does not always translate into reduced consumer spending. For instance, even when consumer confidence hit a record low in June 2022 amid soaring inflation, Americans continued to spend in the following months. However, this time, persistent economic uncertainty could lead to a different outcome.

“It’s too soon to say that recession dynamics are taking hold,” Zandi said. “But this could be a rare case where uncertainty actually leads consumers to pull back.”

Are There Signs of a Recession?

Consumer spending drives nearly 70% of the U.S. economy, making it a crucial indicator of economic health. While there are no clear signs of a major slowdown yet, recent retail sales data raised concerns.

In January, retail sales fell by 0.9% compared to the previous month, marking the first decline since August 2024. Economists believe unseasonably cold weather may have contributed to the drop rather than a fundamental shift in consumer behavior. More comprehensive consumer spending data is expected to be released by the Commerce Department on Friday.

Meanwhile, Walmart, the nation’s largest retailer, recently warned that its sales and profit growth might slow this year due to ongoing financial pressures on low-income consumers caused by inflation and high borrowing costs.

However, some experts argue that the job market is a stronger predictor of economic stability than consumer sentiment. The U.S. job market remains steady, with an unemployment rate of 4% and rising average hourly wages, according to the Labor Department.

Robert Frick, corporate economist at Navy Federal Credit Union, remains optimistic, stating, “The better correlation with spending is consumer income and job market health. At this point, I don’t see a recession unfolding this year.”

Federal Layoffs and Consumer Fears

Despite the overall strength of the labor market, layoffs of federal workers could add to consumer anxiety. The Trump administration, under the leadership of Elon Musk’s Department of Government Efficiency, has begun reducing the federal civilian workforce, which consists of more than 3 million employees.

Although federal jobs make up less than 2% of the 170.7 million jobs in the U.S., some experts warn that such layoffs could lead to a rise in consumer caution. “When job losses hit close to home, people start getting nervous,” Frick explained.

Looking ahead, economists expect a slight increase in the unemployment rate later this year but believe the job market will mostly remain stable.