The United States and China have once again found themselves embroiled in a trade war, with new tariffs and retaliatory measures taking effect. The situation, which could either be a short-lived dispute or the beginning of another prolonged economic standoff, threatens to disrupt global markets.

Tit-for-Tat Tariffs Begin

As of Tuesday, a 10% tariff on all Chinese goods shipped to the US has gone into effect. In response, China has announced tariffs on select US imports. These include a 15% tariff on certain types of coal and liquefied natural gas, alongside a 10% tariff on crude oil, agricultural machinery, and large-displacement vehicles. China’s new tariffs are set to take effect on Monday.

Additionally, China’s Commerce Ministry has placed two major US firms—biotech company Illumina and fashion retailer PVH Group—on its “unreliable entities” list, citing violations of normal market trading principles. This move could significantly impact these companies’ business operations in China.

Potential for Further Escalation

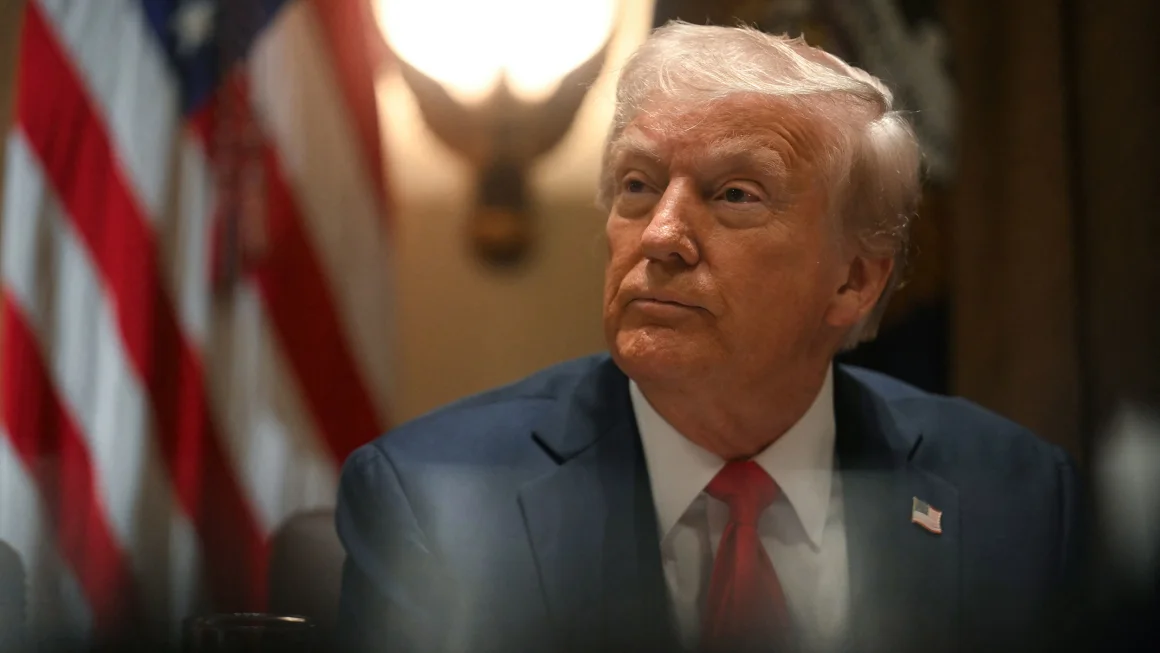

While previous trade disputes have seen temporary resolutions through diplomatic talks, a swift resolution seems unlikely. US President Donald Trump has indicated no urgency to negotiate, stating, “I’m in no rush.” Without a de-escalation agreement, experts warn of the possibility of further tariff increases.

Morgan Stanley economists predict that Trump may go beyond the current 10% tariff, potentially reaching his campaign promise of a 60% tariff on Chinese goods. If this happens, China is expected to retaliate with even more economic countermeasures.

Economic Fallout

For now, the US economy faces limited impact, but that could change if the trade war escalates. American consumers may see higher prices on everyday goods such as electronics, toys, and apparel. Furthermore, businesses that rely on raw materials like rubber, plastic, and chemicals from China may experience rising costs, affecting production and pricing.

US exports to China are also at risk. New Chinese tariffs will affect goods worth $23.6 billion, potentially forcing American businesses to cut jobs. However, China has so far refrained from imposing across-the-board tariffs on all US goods, which last year totaled over $130 billion in exports.

Global Ramifications

Beyond US-China relations, there is growing concern about a wider trade conflict. If the US enforces its planned 25% tariffs on Mexico and Canada after the March 1 deadline, both countries could retaliate. A three-way trade war could significantly weaken the US economy, with Citibank economists predicting a contraction of -0.8% this year and -1.1% next year.

China’s economy is also expected to suffer, but not as severely as the US. Canada and Mexico, however, could take even larger economic hits.

The Uncertain Path Forward

The risks from the escalating trade tensions remain high, with economists warning of supply chain disruptions, rising unemployment, and slower economic growth. “Further sizable increases in tariffs could disrupt supply chains and production, with adverse implications for US employment and growth,” said Nathan Sheets, Citi’s global chief economist. “It’s really hard to put numbers on these effects—but they would be appreciable by any measure.”

As the trade war deepens, businesses and consumers alike brace for its long-term consequences.